Unveiling the Apple Dividend Calendar: A Comprehensive Guide for Investors

Related Articles: Unveiling the Apple Dividend Calendar: A Comprehensive Guide for Investors

Introduction

With great pleasure, we will explore the intriguing topic related to Unveiling the Apple Dividend Calendar: A Comprehensive Guide for Investors. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Unveiling the Apple Dividend Calendar: A Comprehensive Guide for Investors

Apple Inc., a technological titan renowned for its innovative products and services, also stands out for its consistent dividend payouts. Understanding Apple’s dividend history and future prospects is crucial for investors seeking stable income streams and long-term growth. This comprehensive guide delves into the intricacies of Apple’s dividend calendar, providing insights into its historical trends, current practices, and potential future implications.

A Look Back: Apple’s Dividend Journey

Apple’s dividend journey began in 1987, shortly after the company’s initial public offering (IPO). However, the dividend was suspended in 1995 due to financial challenges. It wasn’t until 2012 that Apple reinstated its dividend program, marking a pivotal shift in its shareholder-centric strategy.

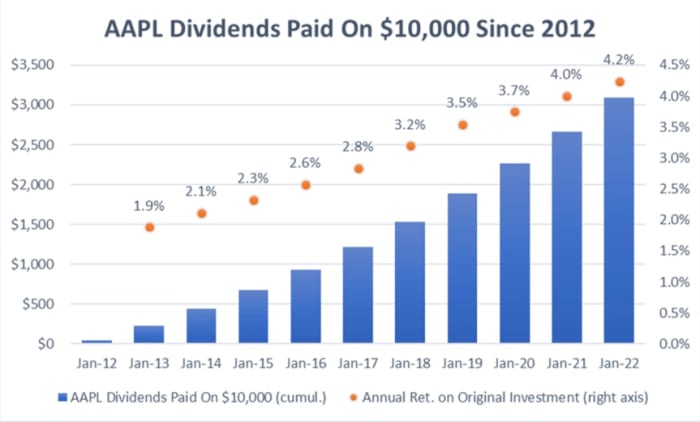

Since its return, Apple’s dividend has consistently increased annually, reflecting the company’s robust financial performance and commitment to rewarding investors. This consistent dividend growth has cemented Apple’s reputation as a reliable income-generating stock, attracting investors seeking stable returns.

Understanding Apple’s Dividend Calendar

The Apple dividend calendar outlines the key dates surrounding the company’s dividend payments. These dates are essential for investors seeking to maximize their returns and ensure timely receipt of their dividends.

Key Dates to Remember:

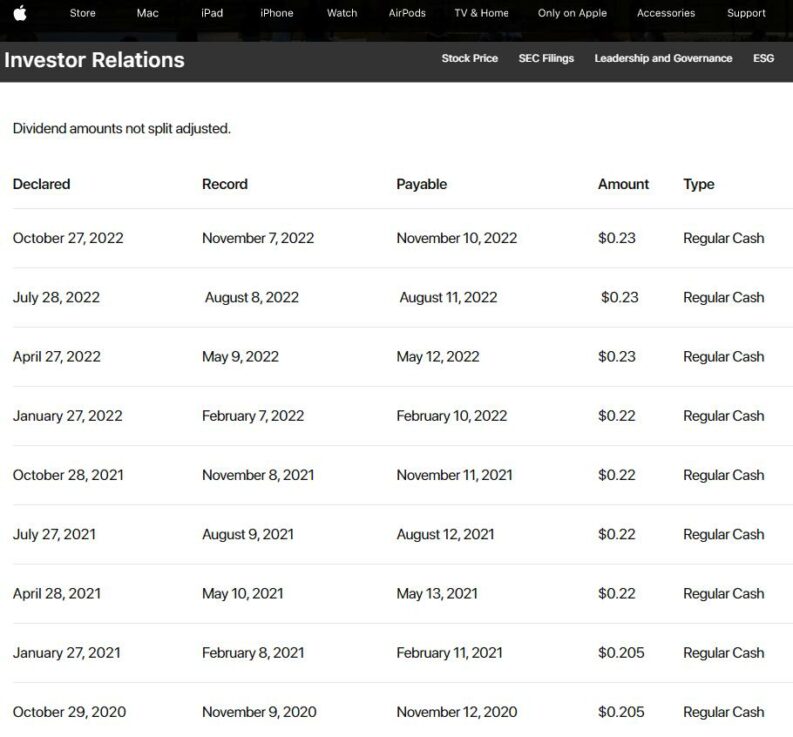

- Declaration Date: This is the date when the company announces its dividend payment. It signals the company’s intention to pay out a specific amount to shareholders.

- Record Date: The record date determines which shareholders are eligible to receive the dividend. Investors who hold shares on or before this date are entitled to the dividend payment.

- Ex-Dividend Date: This date is crucial for investors trading shares. Shares purchased on or after the ex-dividend date are not eligible for the upcoming dividend payment.

- Payment Date: This is the date when the dividend is actually paid out to shareholders.

Factors Influencing Apple’s Dividend Calendar

Several factors influence Apple’s dividend calendar, including:

- Financial Performance: Apple’s dividend payments are directly tied to its financial performance. Strong earnings, robust cash flow, and healthy profitability underpin its ability to maintain and increase dividend payouts.

- Share Buyback Program: Apple actively engages in share buyback programs, which can influence the dividend calendar. Share buybacks can affect the company’s earnings per share, potentially impacting the dividend payout.

- Market Conditions: General market conditions and economic factors also play a role in shaping Apple’s dividend strategy. During periods of economic uncertainty, the company may adjust its dividend policy to preserve capital.

- Management’s Vision: Apple’s management team plays a significant role in setting the dividend policy. Their vision for shareholder value and long-term growth impacts dividend decisions.

Analyzing Apple’s Dividend History: A Trend of Consistent Growth

Analyzing Apple’s dividend history provides valuable insights into the company’s commitment to shareholder returns. Since the reinstatement of its dividend program in 2012, Apple has demonstrated a consistent pattern of annual increases.

- 2012: The first dividend after the reinstatement was $2.65 per share.

- 2022: The dividend has grown to $0.23 per share, reflecting a significant increase over the past decade.

This consistent growth underscores Apple’s commitment to shareholder value and its ability to generate sustainable profits.

Predicting Future Dividend Trends: A Look Ahead

Predicting future dividend trends for Apple is a complex task, but analyzing historical data and current market conditions can provide some insights.

- Continued Growth: Given Apple’s strong financial performance and consistent dividend increases, it’s reasonable to expect continued growth in future dividend payments.

- Sustainability: Apple’s large cash reserves and robust cash flow generation capacity suggest that the company can sustain its dividend program for the long term.

- Market Volatility: Unforeseen market events or economic downturns could potentially impact Apple’s dividend policy.

The Importance of Apple’s Dividend Calendar for Investors

Understanding Apple’s dividend calendar is crucial for investors for several reasons:

- Income Generation: For income-oriented investors, Apple’s dividend payments provide a consistent stream of passive income.

- Investment Strategy: The dividend calendar can inform investors’ investment strategies. Investors seeking income may prioritize stocks with consistent dividend payouts.

- Valuation: Dividend payments can impact a company’s valuation. Stocks with strong dividend histories often attract higher valuations.

- Tax Planning: Investors can use the dividend calendar to plan for tax obligations associated with dividend income.

FAQs about Apple’s Dividend Calendar

1. How often does Apple pay dividends?

Apple pays dividends quarterly, meaning shareholders receive dividend payments four times a year.

2. When is the next Apple dividend payment date?

You can find the specific dates for upcoming dividend payments on Apple’s Investor Relations website or through financial news sources.

3. How do I receive my Apple dividend payment?

Dividend payments are typically credited to shareholders’ brokerage accounts. The specific method of payment may vary depending on the brokerage firm.

4. What happens if I sell my Apple shares before the ex-dividend date?

If you sell your shares before the ex-dividend date, you will be eligible to receive the upcoming dividend payment. However, if you sell your shares on or after the ex-dividend date, you will not receive the dividend.

5. How do I calculate my potential dividend income from Apple?

To calculate your potential dividend income, multiply the current dividend per share by the number of shares you own.

Tips for Optimizing Your Apple Dividend Strategy

- Stay Informed: Monitor Apple’s Investor Relations website and financial news sources for updates on dividend announcements and calendar changes.

- Consider Reinvestment: Explore the option of reinvesting your dividends to purchase additional shares of Apple stock, potentially increasing your overall returns.

- Long-Term Perspective: Approach your Apple dividend strategy with a long-term perspective. Dividend payments are a part of a broader investment plan.

- Diversify Your Portfolio: Don’t solely rely on Apple’s dividend payments. Diversify your investment portfolio to manage risk and potentially enhance returns.

Conclusion

Apple’s dividend calendar provides valuable insights into the company’s commitment to shareholder value and its ability to generate consistent returns. Understanding the key dates and factors influencing Apple’s dividend payments empowers investors to make informed decisions and maximize their investment potential. By staying informed about Apple’s dividend calendar and incorporating its implications into your investment strategies, you can position yourself for long-term success in the ever-evolving world of technology and finance.

Closure

Thus, we hope this article has provided valuable insights into Unveiling the Apple Dividend Calendar: A Comprehensive Guide for Investors. We thank you for taking the time to read this article. See you in our next article!