Navigating the Rhythm of Your Benefits: A Comprehensive Guide to Social Security Payment Dates

Related Articles: Navigating the Rhythm of Your Benefits: A Comprehensive Guide to Social Security Payment Dates

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Rhythm of Your Benefits: A Comprehensive Guide to Social Security Payment Dates. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Navigating the Rhythm of Your Benefits: A Comprehensive Guide to Social Security Payment Dates

- 2 Introduction

- 3 Navigating the Rhythm of Your Benefits: A Comprehensive Guide to Social Security Payment Dates

- 3.1 The Foundation: Understanding the Payment Schedule

- 3.2 The Importance of Timely Payments: Ensuring Financial Stability

- 3.3 FAQs: Addressing Common Concerns

- 3.4 Tips for Managing Your Social Security Benefits Effectively

- 3.5 Conclusion: Embracing Financial Security through Understanding

- 4 Closure

Navigating the Rhythm of Your Benefits: A Comprehensive Guide to Social Security Payment Dates

The Social Security Administration (SSA) provides a lifeline for millions of Americans, offering crucial financial support through retirement, disability, and survivor benefits. Understanding the payment schedule, however, can be a crucial step in ensuring timely access to these vital funds. This comprehensive guide delves into the intricacies of the Social Security payment calendar, providing clarity and empowering individuals to confidently manage their finances.

The Foundation: Understanding the Payment Schedule

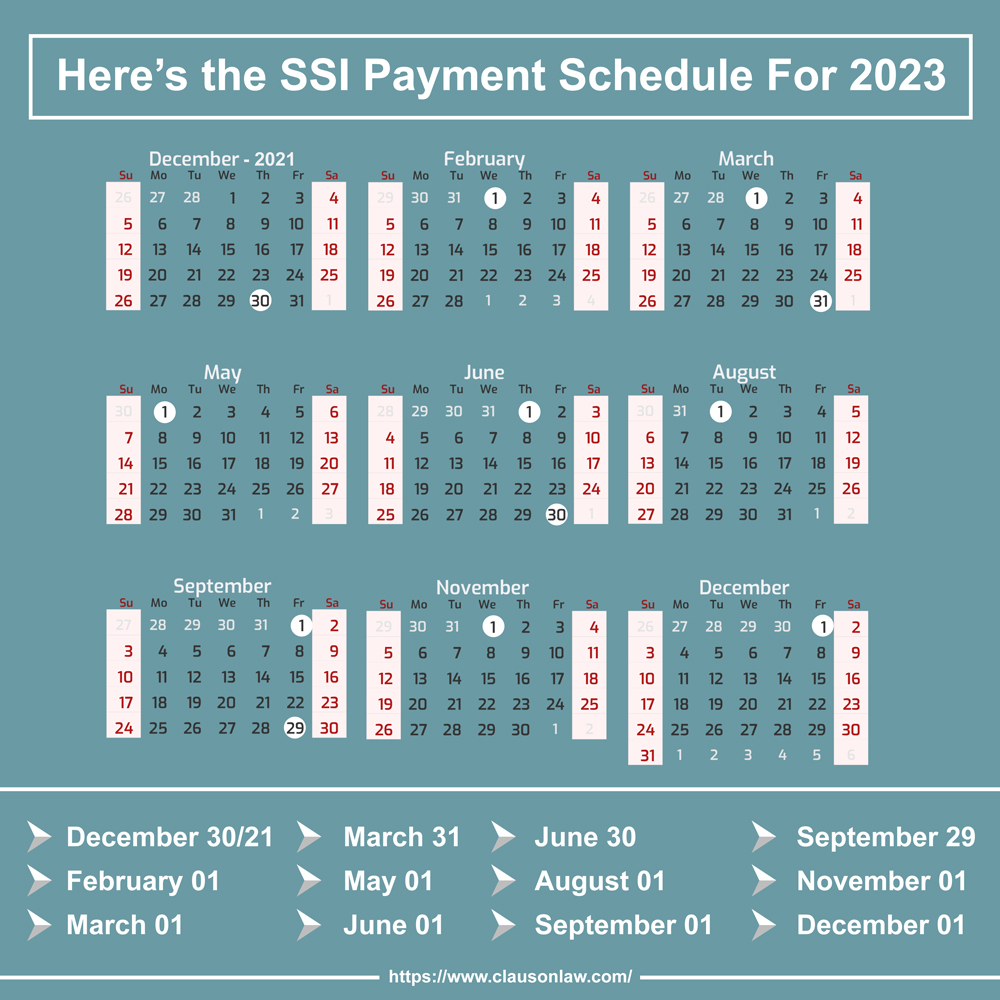

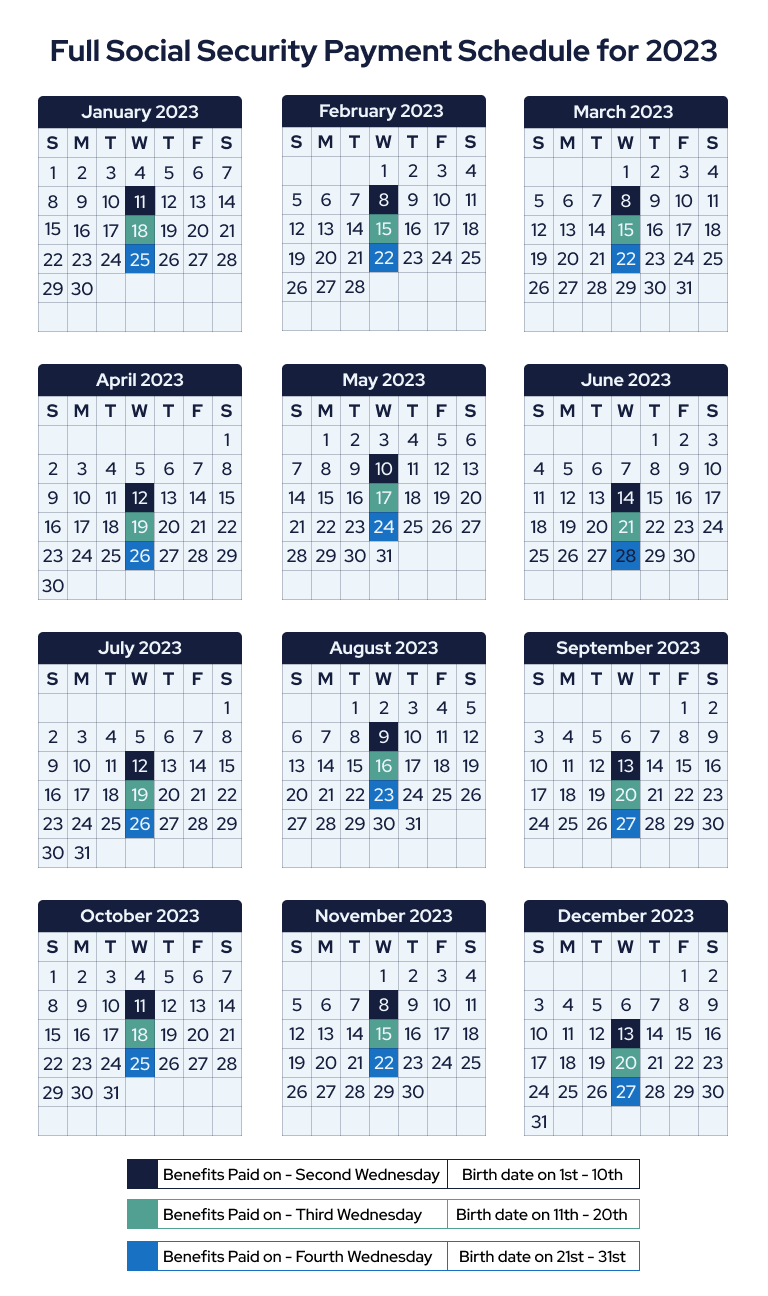

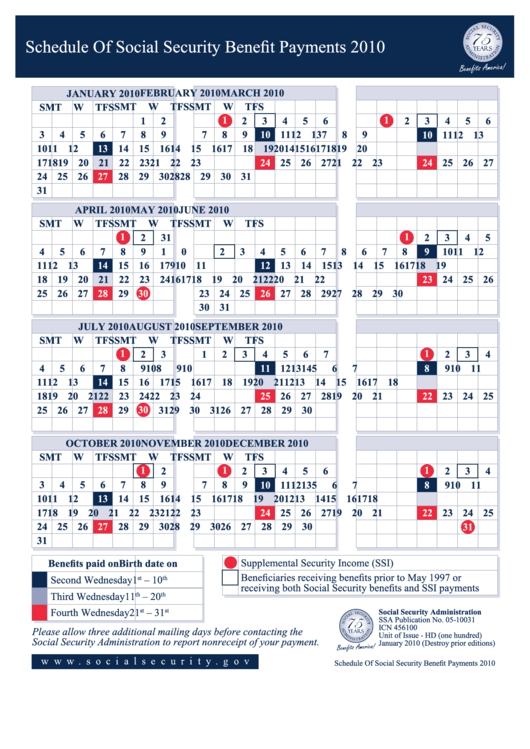

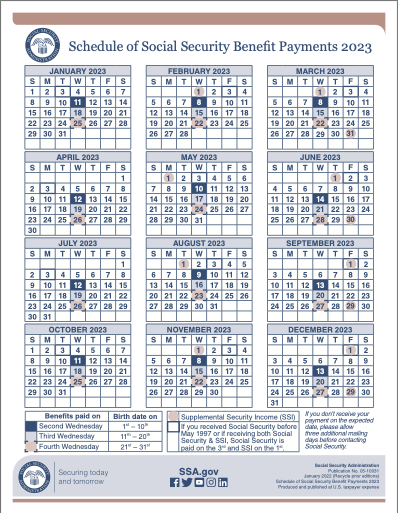

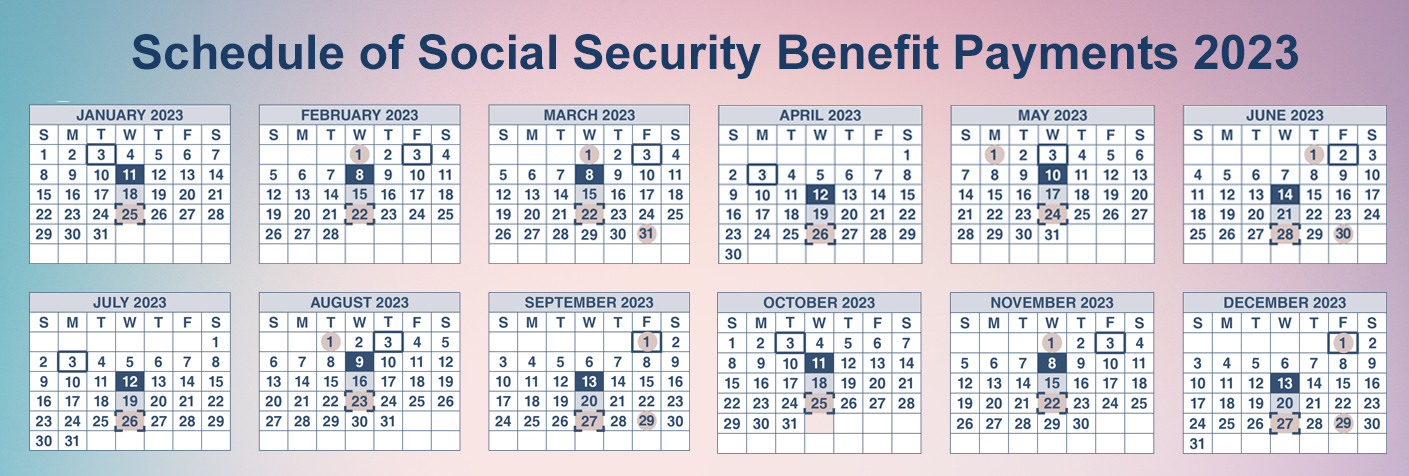

Social Security benefits are typically distributed on the third Wednesday of each month. However, this seemingly straightforward rule is subject to variations based on specific circumstances. The SSA adheres to a calendar, meticulously crafted to ensure consistent and predictable disbursements.

Factors Influencing Payment Dates:

- Weekday Considerations: If the third Wednesday falls on a weekend or holiday, the payment date shifts to the preceding business day. This ensures that recipients receive their benefits promptly, avoiding delays due to official closures.

- Bank Holidays: Regional bank holidays can further impact the payment schedule. If a bank holiday falls within the usual payment window, the disbursement might be delayed until the next business day.

- Direct Deposit: Individuals opting for direct deposit generally receive their benefits on the scheduled payment date. However, delays might occur if bank processing times are extended due to technical issues or unforeseen circumstances.

- Mail Delivery: For those receiving payments through mail, the delivery time depends on the postal service’s efficiency. While the SSA aims for timely delivery, unforeseen delays due to weather or other factors are possible.

Navigating the Calendar:

The SSA provides a comprehensive calendar outlining the payment dates for the entire year. This readily accessible resource offers valuable insights into when to expect benefits, enabling individuals to plan their finances effectively.

Accessing the Payment Calendar:

- SSA Website: The official SSA website is the primary source for accessing the payment calendar. It provides a detailed overview of payment dates for the current and upcoming years.

- SSA Publications: The SSA publishes pamphlets and brochures that include information on payment dates and other important details regarding Social Security benefits.

- SSA Phone Line: The SSA’s toll-free phone line can provide personalized information about payment dates, ensuring accurate and up-to-date details.

The Importance of Timely Payments: Ensuring Financial Stability

Regular and predictable Social Security payments are paramount for millions of Americans, providing financial stability and peace of mind.

Benefits of Timely Payments:

- Meeting Essential Expenses: Timely payments ensure that recipients can cover essential expenses such as rent, utilities, groceries, and healthcare costs.

- Financial Planning: A consistent payment schedule allows for effective budgeting and financial planning, enabling individuals to manage their finances responsibly.

- Avoiding Late Fees: Timely payments prevent the accumulation of late fees on bills, ensuring financial stability and avoiding unnecessary financial burdens.

- Access to Credit: A consistent payment history strengthens creditworthiness, making it easier to access loans and credit lines when needed.

Navigating Potential Delays:

While the SSA strives for consistent and timely payments, delays can occur due to various reasons.

Common Causes of Delays:

- Incorrect Bank Information: Ensure that the bank account information provided to the SSA is accurate and up-to-date.

- Changes in Address: Notify the SSA of any address changes promptly to ensure that payments are delivered to the correct location.

- Verification Processes: The SSA may initiate verification processes to ensure the accuracy of beneficiary information, potentially leading to temporary delays.

- System Errors: Technical glitches or system errors can occasionally cause delays in payment processing.

Addressing Delays:

- Contact the SSA: If a payment is delayed, contact the SSA immediately to inquire about the reason for the delay and possible solutions.

- Review Account Information: Ensure that all personal and banking information is accurate and up-to-date.

- Check for Mail Delays: If receiving payments by mail, inquire with the postal service regarding any potential delays.

FAQs: Addressing Common Concerns

1. What happens if I miss a payment date?

While the SSA strives for consistent payments, unforeseen circumstances can lead to delays. If you miss a payment date, contact the SSA immediately to inquire about the reason for the delay and potential solutions.

2. Can I change my payment date?

The SSA generally does not allow individuals to change their payment dates. The payment schedule is standardized to ensure efficient and consistent disbursements.

3. How can I track my payment status?

The SSA website provides access to an online account where individuals can track their payment status and view past payment history.

4. What if I move and need to update my address?

It is crucial to notify the SSA immediately of any address changes to ensure that payments are delivered to the correct location. This can be done through the SSA website, by phone, or by mail.

5. How can I receive payments directly into my bank account?

Individuals can opt for direct deposit by providing their bank account information to the SSA. This ensures prompt and secure delivery of benefits.

6. What if I am experiencing financial hardship due to a delayed payment?

If facing financial hardship due to a delayed payment, contact the SSA immediately to discuss potential solutions and available resources.

7. Can I receive my Social Security benefits early?

The SSA generally does not offer early payment options. However, specific circumstances, such as a medical emergency, may warrant exceptions. Contact the SSA to discuss your situation.

8. How can I ensure I receive my payments on time?

- Keep your contact information updated with the SSA.

- Opt for direct deposit to ensure timely and secure delivery.

- Regularly check your account information and payment status online.

- Contact the SSA immediately if you experience any issues with your payments.

Tips for Managing Your Social Security Benefits Effectively

- Budgeting: Create a realistic budget that accounts for your regular expenses and anticipated Social Security payments.

- Savings: Consider setting aside a portion of your Social Security payments for emergencies or future financial goals.

- Financial Planning: Consult with a financial advisor to discuss long-term financial planning strategies, including how Social Security benefits can contribute to your overall financial well-being.

- Review Your Benefits: Regularly review your benefit statements to ensure accuracy and identify any potential discrepancies.

- Stay Informed: Stay informed about updates and changes to Social Security regulations and benefits.

Conclusion: Embracing Financial Security through Understanding

The Social Security payment calendar serves as a vital tool for navigating the financial landscape, offering predictability and peace of mind. Understanding the payment schedule, factors influencing payment dates, and common causes of delays empowers individuals to manage their finances effectively. By actively engaging with the SSA and utilizing available resources, recipients can ensure timely access to their benefits, fostering financial stability and empowering them to navigate life’s challenges with confidence.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Rhythm of Your Benefits: A Comprehensive Guide to Social Security Payment Dates. We thank you for taking the time to read this article. See you in our next article!