Navigating the Cornell Payroll Calendar: A Comprehensive Guide for Employees

Related Articles: Navigating the Cornell Payroll Calendar: A Comprehensive Guide for Employees

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Cornell Payroll Calendar: A Comprehensive Guide for Employees. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Cornell Payroll Calendar: A Comprehensive Guide for Employees

![cornell Payroll Financial Report for [NetID] IT@Cornell](https://it.cornell.edu/sites/default/files/payroll-phish.png)

The Cornell University payroll calendar serves as a crucial guide for employees, outlining key dates for salary disbursements and other related financial matters. Understanding this calendar is essential for effective financial planning and ensuring timely receipt of compensation. This comprehensive guide provides a detailed explanation of the Cornell payroll calendar, its importance, and how to effectively utilize its information.

Understanding the Fundamentals of the Cornell Payroll Calendar

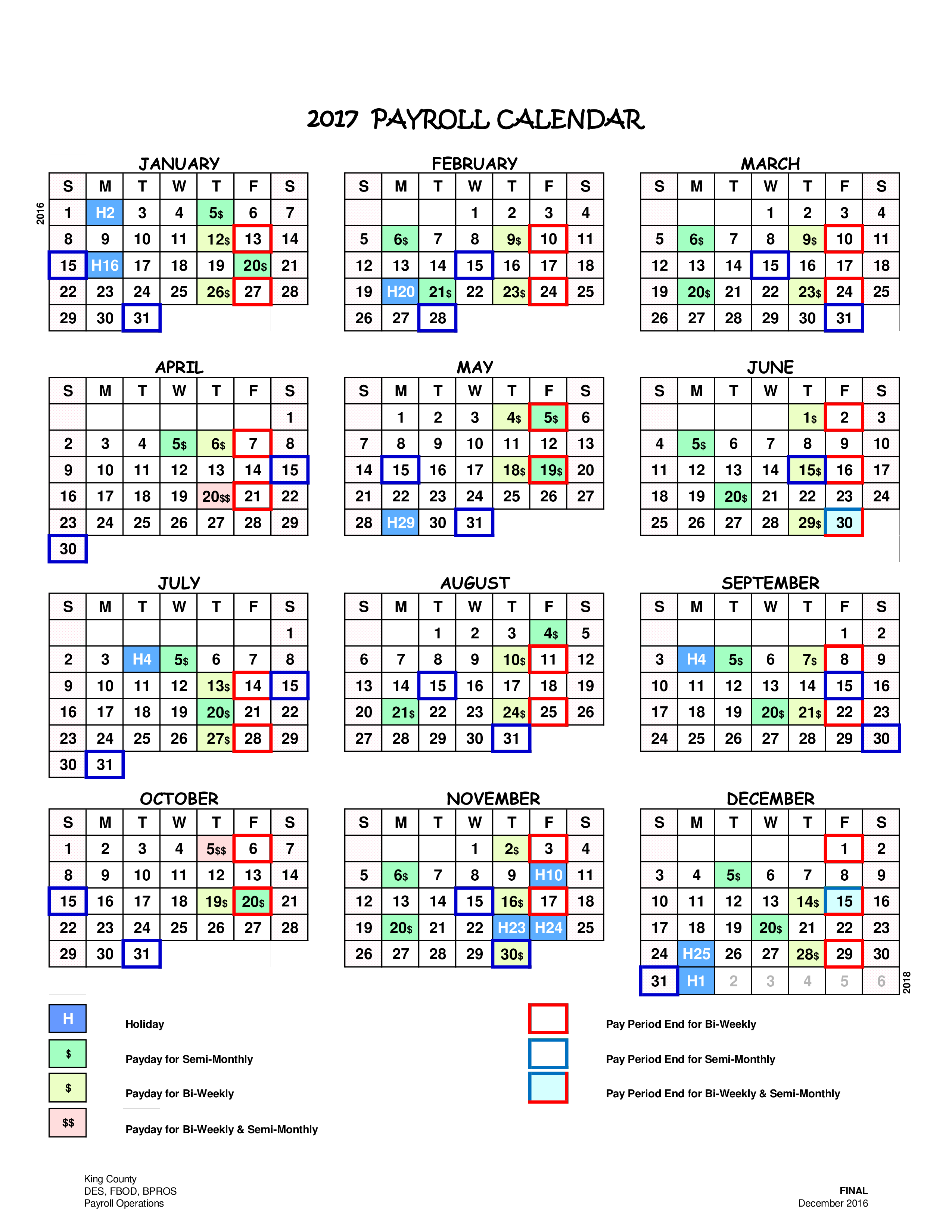

The Cornell payroll calendar is a meticulously crafted schedule that details the specific dates on which employees can expect their paychecks to be processed and deposited. This calendar is typically published annually, providing employees with a clear roadmap for their financial planning throughout the year.

Key Elements of the Cornell Payroll Calendar

The Cornell payroll calendar encompasses several key elements that are essential for employees to understand:

- Pay Dates: The most prominent feature of the calendar is the listing of pay dates. These dates indicate when employees can expect their salaries to be deposited into their designated bank accounts.

- Payroll Cutoffs: Alongside pay dates, the calendar also specifies payroll cutoffs. These cutoffs represent the deadline for submitting time and attendance records, ensuring accurate calculation and timely disbursement of wages.

- Holidays: The calendar prominently displays holidays, highlighting dates when the university observes official closures. These closures may impact the processing of payroll and affect the timing of paychecks.

- Other Important Dates: The calendar may also include other relevant dates, such as deadlines for submitting expense reports or tax-related information.

The Significance of the Cornell Payroll Calendar

The Cornell payroll calendar plays a vital role in the financial well-being of employees. It provides numerous benefits, including:

- Financial Planning: The calendar empowers employees to plan their finances effectively, knowing the exact dates on which they will receive their salaries. This predictability allows for budgeting, debt management, and other financial decisions.

- Timely Payment: The calendar ensures that employees receive their paychecks promptly, minimizing any financial strain or disruption caused by delayed payments.

- Increased Transparency: The publication of the payroll calendar promotes transparency and accountability, allowing employees to understand the payroll process and its associated timelines.

- Reduced Stress: By providing a clear roadmap for payroll disbursement, the calendar helps alleviate stress and uncertainty associated with receiving compensation.

Accessing the Cornell Payroll Calendar

The Cornell payroll calendar is readily accessible through various channels:

- Cornell University Website: The official website of Cornell University typically hosts the payroll calendar in a dedicated section for Human Resources or Finance.

- Employee Intranet: Employees with access to the Cornell intranet can often find the payroll calendar within the employee portal or related resources.

- Payroll Department: Employees can directly contact the Cornell payroll department for assistance in accessing the calendar or for any inquiries related to payroll matters.

Effective Utilization of the Cornell Payroll Calendar

To maximize the benefits of the Cornell payroll calendar, employees should:

- Review the Calendar Regularly: Employees should familiarize themselves with the calendar’s contents and review it regularly to stay informed about upcoming pay dates, cutoffs, and other important deadlines.

- Set Reminders: To avoid missing crucial deadlines, employees can set reminders for important dates, such as payroll cutoffs, using calendar applications or other notification tools.

- Plan Finances Accordingly: The calendar facilitates financial planning by providing a clear understanding of salary disbursement dates. Employees can use this information to budget effectively and manage their finances responsibly.

- Communicate with Payroll: For any questions or concerns related to payroll, employees should promptly contact the Cornell payroll department for clarification and assistance.

Frequently Asked Questions (FAQs) about the Cornell Payroll Calendar

Q: What happens if I miss a payroll cutoff deadline?

A: Missing a payroll cutoff deadline may result in delayed payment. It is crucial to submit time and attendance records within the specified timeframe to ensure timely processing and disbursement of wages.

Q: How often is the Cornell payroll calendar updated?

A: The Cornell payroll calendar is typically published annually, with updates reflecting changes in pay dates, holidays, or other relevant information.

Q: Can I access the Cornell payroll calendar on my mobile device?

A: The Cornell payroll calendar is typically accessible through the university website, which is compatible with most mobile devices. Alternatively, employees can save the calendar to their personal device or use a calendar application to access it.

Q: What if there is a discrepancy in my paycheck?

A: If you notice any discrepancies in your paycheck, it is essential to contact the Cornell payroll department immediately. They can investigate the issue and provide necessary corrections or explanations.

Tips for Effective Payroll Management

- Maintain Accurate Time Records: Employees should ensure their time and attendance records are accurate and submitted promptly to avoid any discrepancies in pay calculations.

- Review Paystubs Regularly: Regularly reviewing paystubs helps identify any errors or inconsistencies in deductions, taxes, or other payroll components.

- Stay Informed About Payroll Policies: Employees should familiarize themselves with Cornell’s payroll policies and procedures, including deductions, tax regulations, and other relevant information.

- Seek Professional Advice: For complex payroll-related questions, employees can seek advice from financial professionals or the Cornell payroll department.

Conclusion

The Cornell payroll calendar is a vital tool for employees, providing clarity and predictability in their financial planning. By understanding its contents and utilizing its information effectively, employees can ensure timely receipt of compensation, manage their finances responsibly, and minimize any potential financial disruptions. Regularly reviewing the calendar, staying informed about payroll policies, and seeking assistance when needed are key to navigating the payroll process smoothly and confidently.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Cornell Payroll Calendar: A Comprehensive Guide for Employees. We appreciate your attention to our article. See you in our next article!