Navigating the 2025 Federal Tax Refund Calendar: A Comprehensive Guide

Related Articles: Navigating the 2025 Federal Tax Refund Calendar: A Comprehensive Guide

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the 2025 Federal Tax Refund Calendar: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the 2025 Federal Tax Refund Calendar: A Comprehensive Guide

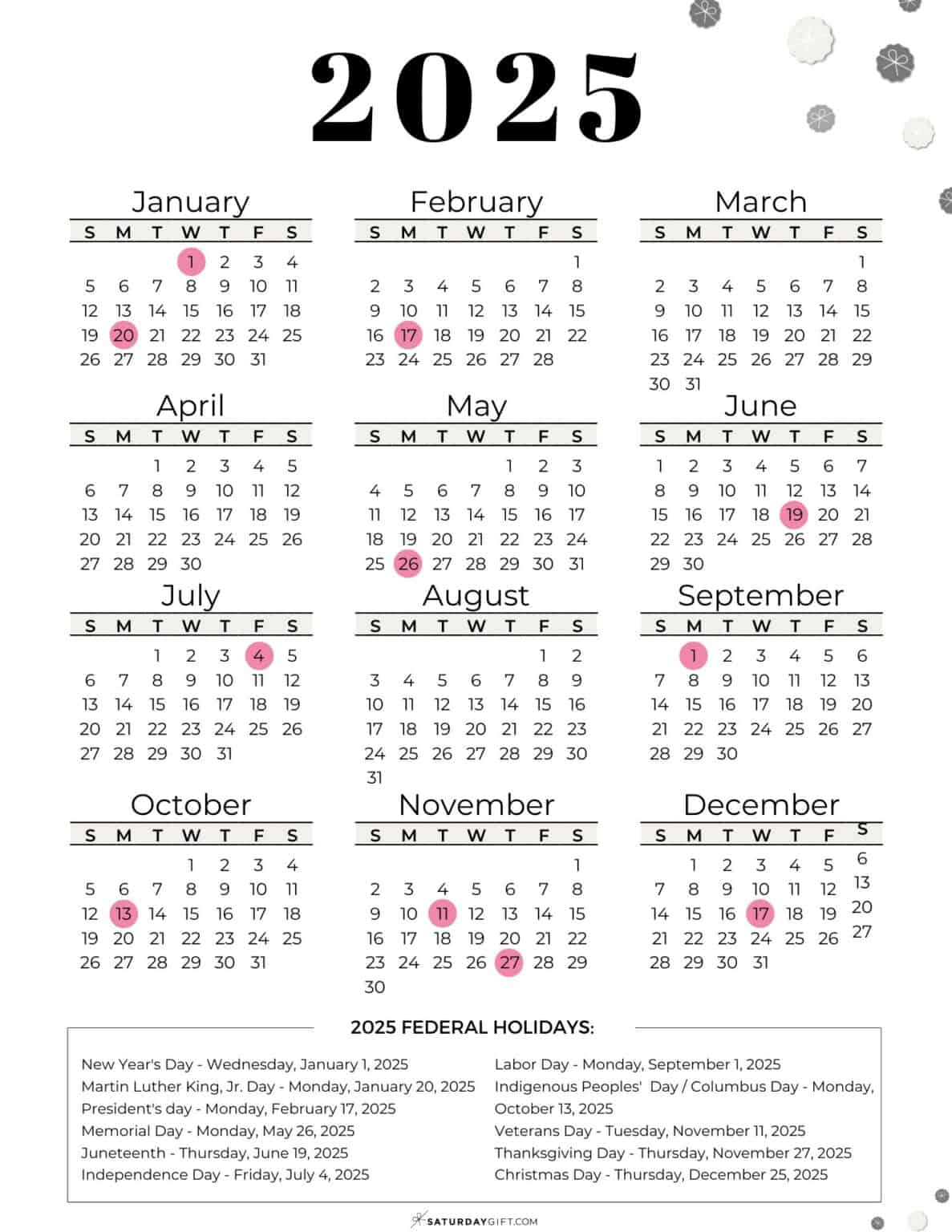

The 2025 federal tax refund calendar serves as a crucial roadmap for taxpayers, outlining the key dates and deadlines for filing their tax returns and receiving potential refunds. Understanding this calendar is essential for ensuring timely and accurate tax compliance, potentially maximizing refunds and avoiding penalties.

Understanding the 2025 Federal Tax Filing Season

The 2025 tax filing season, encompassing the period during which taxpayers can file their returns, is typically determined by the Internal Revenue Service (IRS). While the specific dates may vary slightly from year to year, the 2025 tax filing season is expected to begin in late January and conclude in mid-April.

Key Dates to Remember:

- Tax Filing Deadline: The standard deadline for filing federal income tax returns is typically April 15th. However, this deadline may shift if April 15th falls on a weekend or holiday. In such cases, the deadline is extended to the next business day.

- Tax Payment Deadline: The deadline for paying federal income taxes is also generally April 15th. However, taxpayers may request an extension to file their return, which extends the filing deadline to October 15th. It is crucial to note that an extension to file does not extend the deadline for paying taxes.

- Estimated Tax Payments: For individuals who are self-employed or have income from sources other than employment, such as investments or rental properties, estimated tax payments may be required throughout the year. These payments are typically made quarterly, with deadlines falling on April 15th, June 15th, September 15th, and January 15th of the following year.

Factors Influencing Refund Processing Time:

The time it takes to receive a tax refund varies depending on several factors, including:

- Method of Filing: Filing electronically generally leads to faster processing times compared to paper filing.

- Accuracy of Information: Errors or omissions on tax returns can cause delays in processing.

- IRS Workload: The IRS may experience increased workloads during peak filing seasons, leading to longer processing times.

- Verification Requirements: If the IRS requires additional information or verification, this can delay the refund process.

Tips for a Smooth Tax Filing Experience:

- Gather Necessary Documents: Organize all relevant tax documents, including W-2 forms, 1099 forms, receipts, and other documentation.

- File Electronically: E-filing is generally faster and more accurate than paper filing.

- Use Tax Software: Tax preparation software can help ensure accuracy and streamline the filing process.

- Double-Check Information: Carefully review all information before submitting your tax return.

- Track Your Refund: Use the IRS’s online tool, "Where’s My Refund?," to track the status of your refund.

Frequently Asked Questions:

-

What is the difference between filing and paying taxes?

- Filing taxes refers to the process of submitting a tax return to the IRS, detailing your income and expenses.

- Paying taxes refers to the obligation to remit the calculated tax liability to the government.

-

What is an extension to file?

- An extension to file allows taxpayers additional time to prepare and submit their tax return. However, it does not extend the deadline for paying taxes.

-

What are estimated tax payments?

- Estimated tax payments are quarterly payments made by self-employed individuals and others with income from sources other than employment, to ensure they pay taxes throughout the year.

-

What happens if I miss the tax filing deadline?

- Penalties may be assessed for late filing and late payment.

-

How can I track my refund?

- The IRS provides an online tool, "Where’s My Refund?," which allows taxpayers to track the status of their refund.

Conclusion:

Navigating the 2025 federal tax refund calendar requires careful planning and attention to detail. By understanding key deadlines, filing electronically, and using tax preparation software, taxpayers can ensure timely and accurate compliance, potentially maximizing their refunds and avoiding penalties. The IRS offers various resources and tools to assist taxpayers in navigating the process, ensuring a smoother and more informed experience.

Closure

Thus, we hope this article has provided valuable insights into Navigating the 2025 Federal Tax Refund Calendar: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!