Aligning Fiscal and Calendar Years: A Strategic Business Decision

Related Articles: Aligning Fiscal and Calendar Years: A Strategic Business Decision

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Aligning Fiscal and Calendar Years: A Strategic Business Decision. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Aligning Fiscal and Calendar Years: A Strategic Business Decision

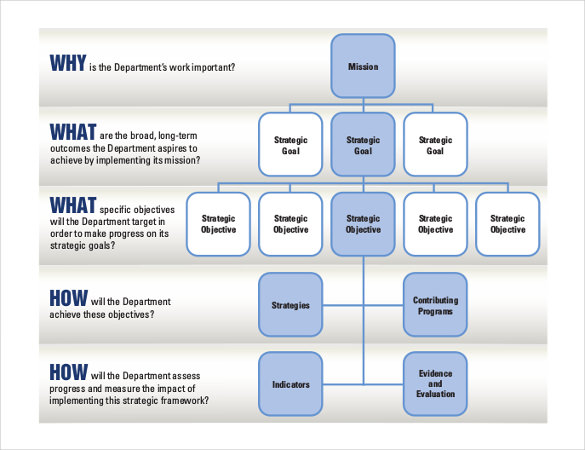

In the realm of business operations, the concept of a fiscal year takes center stage, defining the period for which financial records are maintained and reported. While businesses have the flexibility to choose their fiscal year, aligning it with the calendar year offers a multitude of advantages, streamlining operations and enhancing strategic decision-making. This article explores the compelling reasons why aligning a company’s fiscal year with the calendar year can be a strategically sound choice, illuminating its benefits across various aspects of business.

Understanding the Fiscal Year and Its Significance

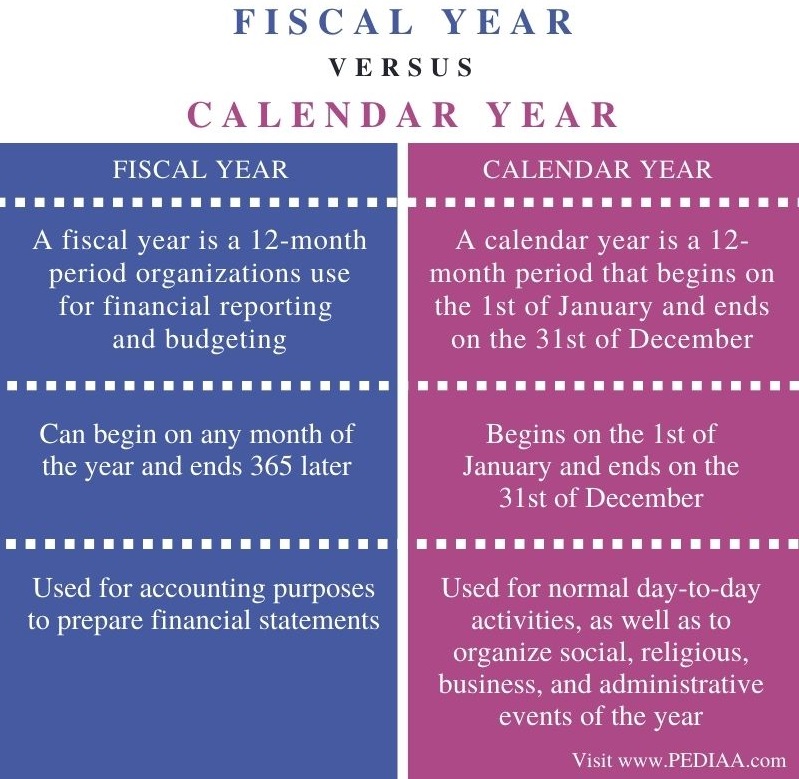

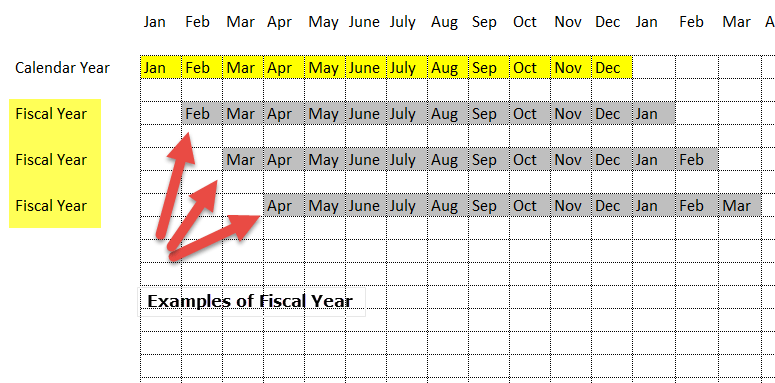

A fiscal year represents the accounting period for a company, typically spanning 12 months. It serves as the foundation for financial reporting, budgeting, and performance evaluation. By establishing a clear financial cycle, businesses can effectively track revenue, expenses, and profitability, providing valuable insights for informed decision-making.

The Case for Aligning Fiscal and Calendar Years

While businesses have the freedom to choose their fiscal year, aligning it with the calendar year presents a compelling strategic advantage. This alignment simplifies financial reporting, enhances forecasting accuracy, and fosters seamless integration with external stakeholders.

1. Simplified Financial Reporting and Analysis

When a company’s fiscal year aligns with the calendar year, financial reporting becomes streamlined and intuitive. Reports are generated at the end of December, coinciding with the calendar year-end. This synchronicity eliminates the need for complex adjustments and conversions between fiscal and calendar year data, facilitating clearer and more straightforward financial analysis.

2. Enhanced Forecasting Accuracy

Aligning the fiscal year with the calendar year allows businesses to leverage readily available economic data and market trends associated with the calendar year. This readily accessible information improves the accuracy of financial forecasting, enabling more reliable predictions of future revenue, expenses, and profitability.

3. Improved Internal and External Communication

When financial reporting cycles align with the calendar year, internal communication within the organization becomes more efficient. Employees and departments are accustomed to year-end reporting and performance reviews, fostering a shared understanding of financial goals and progress. External stakeholders, such as investors, creditors, and regulators, also benefit from this alignment, as financial data becomes readily accessible and interpretable without requiring complex conversions.

4. Seamless Integration with External Stakeholders

Aligning the fiscal year with the calendar year ensures seamless integration with external stakeholders, particularly investors and financial institutions. Most financial institutions and regulatory bodies operate on a calendar year basis. Aligning the fiscal year with this standard facilitates streamlined reporting and communication, fostering smoother relationships with external partners.

5. Enhanced Business Efficiency

By aligning the fiscal year with the calendar year, businesses can streamline their operations, minimizing the need for separate accounting cycles and reporting processes. This simplification reduces administrative burdens, frees up resources, and allows for more efficient allocation of time and effort.

6. Improved Performance Measurement and Benchmarking

When comparing performance across different periods, aligning the fiscal year with the calendar year provides a consistent framework for measurement and benchmarking. This consistency allows businesses to track their progress effectively, identify areas for improvement, and compare their performance to industry standards.

7. Enhanced Tax Planning and Compliance

Tax planning and compliance become more efficient when the fiscal year aligns with the calendar year. Businesses can readily access tax-related information and guidance associated with the calendar year, simplifying tax compliance and minimizing potential errors.

FAQs Regarding Aligning Fiscal and Calendar Years

Q: Is aligning the fiscal year with the calendar year mandatory for all businesses?

A: No, aligning the fiscal year with the calendar year is not mandatory. Businesses have the freedom to choose their fiscal year based on their specific needs and industry practices. However, aligning with the calendar year often offers significant advantages.

Q: What are the potential drawbacks of aligning the fiscal year with the calendar year?

A: While aligning with the calendar year offers numerous benefits, potential drawbacks include:

- Seasonal fluctuations: Businesses with highly seasonal revenue streams might find it challenging to align their fiscal year with the calendar year.

- Industry norms: Certain industries might have established practices that deviate from the calendar year alignment.

Q: How can a business transition from a non-calendar year fiscal year to a calendar year fiscal year?

A: Transitioning to a calendar year fiscal year involves careful planning and execution. Key steps include:

- Determining the transition period: This involves selecting a specific period for the transition, such as a shorter or longer fiscal year.

- Adjusting accounting records: This step requires adjusting financial records to reflect the new fiscal year and ensuring consistency in reporting.

- Communicating the change: Clear communication with stakeholders, including employees, investors, and regulators, is crucial to ensure understanding and transparency.

Tips for Aligning a Fiscal Year with the Calendar Year

- Conduct a thorough analysis: Evaluate the potential benefits and drawbacks of aligning the fiscal year with the calendar year for your specific business.

- Consult with financial experts: Seek guidance from accounting professionals to ensure a smooth transition and accurate financial reporting.

- Communicate effectively: Clearly inform stakeholders about the change and its implications.

- Implement a phased approach: Consider a phased transition to minimize disruption and ensure a seamless transition.

Conclusion

Aligning a company’s fiscal year with the calendar year offers significant advantages, streamlining financial reporting, enhancing forecasting accuracy, and fostering seamless integration with external stakeholders. While businesses have the freedom to choose their fiscal year, aligning it with the calendar year often presents a strategic advantage, contributing to operational efficiency, improved decision-making, and enhanced stakeholder relationships. By carefully considering the potential benefits and drawbacks, businesses can make informed decisions regarding their fiscal year, optimizing their financial management and contributing to long-term success.

:max_bytes(150000):strip_icc()/FY-887c7c1cad1c47f38bd91db6e080b68e.jpg)

Closure

Thus, we hope this article has provided valuable insights into Aligning Fiscal and Calendar Years: A Strategic Business Decision. We hope you find this article informative and beneficial. See you in our next article!